Is Marathon Insurance Worth It

Marathon insurance is worth it if you want comprehensive coverage for your health, home, or vehicle. By providing extensive protection and peace of mind, Marathon insurance offers great value for your investment.

Whether you’re looking for robust health coverage, dependable home insurance, or reliable auto protection, Marathon insurance can offer the security and assurance you need. With competitive rates and a range of customizable options, Marathon insurance provides tailored solutions to meet your specific needs.

Additionally, their responsive customer service and easy claims process make the overall experience hassle-free and convenient. If you prioritize quality coverage and reliable service, Marathon insurance is definitely worth considering for your insurance needs.

Credit: www.instagram.com

Factors To Consider

Deciding whether marathon insurance is worth it involves evaluating various factors that can impact your decision. Consider the following:

Risks Involved

- Assess potential injury risks during a marathon event

- Evaluate risk of cancellation due to unforeseen circumstances

- Understand liability risks in case of accidents or damage

Coverage Offered

- Check if the policy includes medical coverage

- Review coverage limits and exclusions in the policy

- Ensure the policy offers protection for race-related issues

Credit: www.runnersworld.com

Cost Analysis

When considering marathon insurance, it’s crucial to assess the cost to determine if it’s worth investing in. The cost analysis involves examining the premium cost, deductibles, and co-pays to determine the overall value of the insurance.

Premium Cost

The premium cost for marathon insurance can vary based on factors such as age, health history, coverage limits, and geographic location. It’s important to carefully review the premium cost to ensure it aligns with your budget and provides adequate coverage.

Deductibles And Co-pays

Understanding the deductibles and co-pays associated with marathon insurance is essential for evaluating its value. Deductibles represent the amount you must pay out-of-pocket before the insurance coverage kicks in, while co-pays are fixed amounts you pay for certain services. It’s crucial to consider these costs to gauge the overall affordability of the insurance plan.

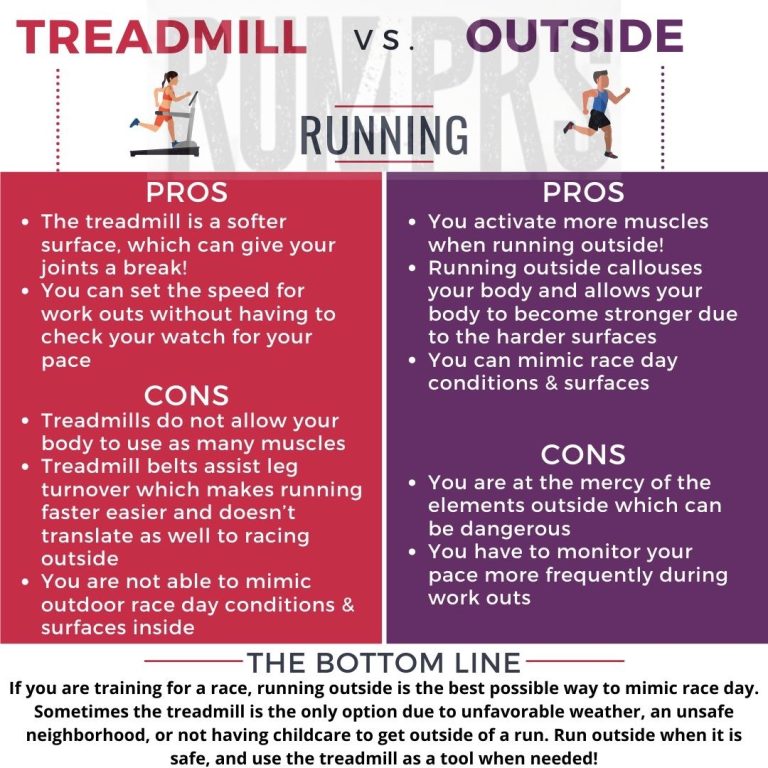

Comparison With Other Insurance Options

Short-term Insurance

If you’re seeking coverage for a shorter time frame or in between jobs, short-term insurance may be a viable option. This type of insurance provides temporary coverage for a limited period, typically six months to a year. Although it offers lower premiums and flexibility, it usually does not cover pre-existing conditions and may have limited benefits and high deductibles.

Health Savings Accounts

Health Savings Accounts (HSAs) provide another alternative for managing healthcare costs. HSAs allow individuals to save money tax-free for medical expenses. This option is best for those willing to take on more financial responsibility and are in good health. However, it requires a high-deductible health plan and doesn’t offer the comprehensive coverage often provided by marathon insurance.

Benefits Of Marathon Insurance

Extended Coverage

Marathon Insurance offers broad coverage, protecting you in various situations beyond basic insurance.

Access To Specialists

With Marathon Insurance, you can easily access specialized healthcare providers for your specific needs.

Limitations And Exclusions

Limitations and exclusions are an important aspect to consider when evaluating the worth of marathon insurance. Understanding the scope of coverage and the situations in which it may not apply can help you make an informed decision. This section explores two key areas: pre-existing conditions and non-medical coverage.

Pre-existing Conditions

When it comes to marathon insurance, pre-existing conditions are often subject to limitations and exclusions. These are medical conditions or illnesses that you were diagnosed with or sought treatment for prior to applying for coverage. Insurance providers may impose waiting periods or exclude coverage for these conditions to mitigate their financial risk.

It’s crucial to thoroughly review the policy’s terms and conditions to see if any pre-existing conditions are excluded or if there are waiting periods before coverage kicks in. This ensures that you have a clear understanding of the limitations associated with your specific situation and can make an informed decision.

Non-medical Coverage

Non-medical coverage is another aspect that may have limitations and exclusions in marathon insurance policies. While these policies primarily focus on medical expenses related to marathon participation, they may offer additional coverage beyond healthcare.

Common areas of non-medical coverage can include trip cancellation, lost baggage, or even liability for accidents caused by the insured during the marathon event. However, some policies may have exclusions for certain activities or conditions. It is important to carefully read the policy to understand what is covered and what is not under the non-medical coverage section.

In conclusion, it is vital to thoroughly review the limitations and exclusions of marathon insurance policies. This ensures you are aware of any pre-existing condition limitations or exclusions as well as the scope of coverage provided under the non-medical section. By understanding these factors, you can make an informed decision about whether marathon insurance is worth it for you.

Credit: www.facebook.com

Frequently Asked Questions For Is Marathon Insurance Worth It

Is Race Insurance Worth It?

Race insurance can be beneficial for those involved in competitive racing, providing financial protection in case of accidents or injuries. It offers peace of mind and helps cover potential medical expenses and damage to vehicles. Considering the risks involved in racing, it may be worth considering race insurance.

How Does Race Insurance Work?

Race insurance covers financial losses related to race events, such as cancellations, injuries, or property damage. It provides peace of mind for participants and event organizers.

How Does Marathon Insurance Protect Runners?

Marathon insurance provides coverage for medical expenses, trip cancellation, and liability protection if accidents occur during the race.

Conclusion

After considering the benefits and risks, getting marathon insurance can provide peace of mind. It safeguards your investment and health during races. Make an informed decision based on your needs and personal circumstances. Prioritize protection and enjoy your running journey worry-free.

Invest in marathon insurance for added security.